When Must You Register Stock Sales With The Sec

Rule 144 – Selling Restricted and Control Stock

The Securities Act of '33 requires securities sold in the U.S. must be registered with SEC, with limited exceptions for certain types of securities (exempt securities) and certain types of transactions (due east.g. Reg D, Reg Due south, Reg A, and more). One such exempt transaction is a Rule 144 transaction, which allows public resale of restricted and command securities without registration if a number of weather condition are met. This mail service will review: 1) the definitions of restricted and command stock, and 2) the conditions required to sell these securities to the public.

sold in the U.S. must be registered with SEC, with limited exceptions for certain types of securities (exempt securities) and certain types of transactions (due east.g. Reg D, Reg Due south, Reg A, and more). One such exempt transaction is a Rule 144 transaction, which allows public resale of restricted and command securities without registration if a number of weather condition are met. This mail service will review: 1) the definitions of restricted and command stock, and 2) the conditions required to sell these securities to the public.

DEFINITIONS IN Rule 144

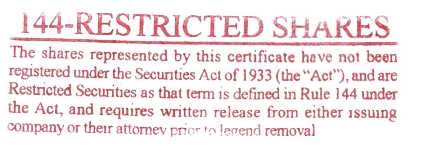

Restricted Securities: Restricted securities are unregistered with the SEC. Investors acquire restricted (i.e. unregistered) securities in a variety of means include:

- Private placement offerings,

- Regulation D offerings,

- Employee stock benefit plans,

- Every bit compensation for professional services, or

- In commutation for providing "seed money" or beginning-up capital to the visitor.

Command Securities:Control securities are those owned by an affiliate (or insider) of the issuing company. Control securities are entirely adamant by ownership (not whether the shares are restricted, or accept been registered). An affiliate is defined as:

- An executive officer (e.yard. CEO, CFO, or COO),

- A director (an individual on the issuer'south board of directors) or

- Large shareholder (typically defined as owning more than 10% of the issuer'due south stock)

Conditions REQUIRED TO SELL Nether Dominion 144

| Restricted Stock | Control Stock | |

| Belongings Period | Belongings period 1) half-dozen months for SEC filers 2) 12 months for non-SEC reporting companies NOTES: – The property flow begins when the securities are bought and fully paid for. – Purchases of restricted shares permit y'all to tack-on (or aggregate) the previous owner'southward belongings flow to your belongings period. | Non applicable |

| Volume Limitations | Not applicative | The quantity of command shares is limited to the greater of: 1) one% of the outstanding shares, or 2) The average reported weekly trading volume during the iv weeks preceding the sale |

| Current Public Information | There must be adequate electric current information most the issuing company publicly available to sell restricted shares under Rule 144. This can be satisfied with: – 10Ks and 10Qs for reporting companies, or – Information such every bit a concern description, the identity of its officers and directors, and its financial statements for non-reporting issuers. | Non applicative |

| Discover of Auction (Filing requirements) | None required | Affiliates selling control securities must file Form 144 with the SEC before the auction. The discover and then opens a xc day window in which the shares can be sold. There is a filing exception if the auction is for: 1) Fewer than 5,000 shares, or 2) The total dollar amount is less than $50,000 |

Knopman Notes: If an chapter (insider) is selling restricted stock (i.e. unregistered shares) the sale must comply with ALL conditions (both restricted and control).

Understanding the diverse means securities can be issued and sold is a critical part of preparing for most FINRA exams. A house grasp on the definitions and the application of the rules, and the interplay between the rules, will serve candidates well in demonstrating their knowledge in their regulatory examinations.

Relevant Exams:

Series 7, Series 24, Series 65, Series 66, Series 79

Source: https://knopman.com/blog/2014/04/23/rule-144-selling-restricted-and-control-stock/

Posted by: mendezmagning1940.blogspot.com

0 Response to "When Must You Register Stock Sales With The Sec"

Post a Comment